HIGHLIGHTS

Purpose and Values

Milan, 30 April 2025 - The Prada S.p.A. Board of Directors, which convened today, reviewed and approved the consolidated revenue performance for the first quarter ended March 31, 2025.

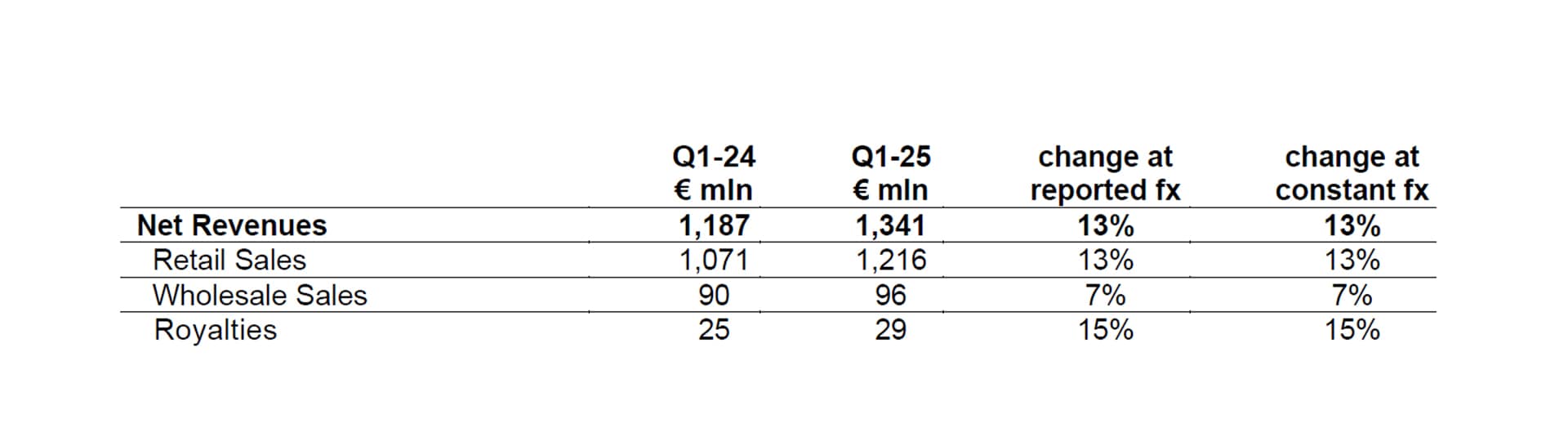

Key highlights (growth percentage at constant currency)

Patrizio Bertelli, Prada Group Chairman and Executive Director, commented:

“We are pleased with another quarter of solid performance. In an increasingly turbulent and uncertain landscape, we continued to execute with confidence and discipline, leveraging creativity and the strength of our organisation. The current environment requires us to be agile and flexible; at the same time, we believe it is essential to continue to invest with a long-term mindset, preserving and developing craftmanship and know-how, supporting our partners and strengthening our infrastructure.”

Andrea Guerra, Group Chief Executive Officer, added:

“The Group had a positive start to the year. Prada showed strong resilience, against the most challenging quarterly comparison of 2024; the comps will ease slightly in the second half of the year but we expect the backdrop to remain complex. Notwithstanding the headwinds, Miu Miu confirmed a remarkable growth trajectory. Looking ahead, our strategy remains centred on our brands, their relevance, creativity and marked sensibility in reading the spirit of the time. Sharp execution will be key in this environment and to continue to deliver on our ambition of solid, sustainable and above-market growth.”

Prada’s distinctive take on contemporaneity continued to nurture the brand’s desirability and cultural relevance. A well-balanced product category mix supported a resilient performance, with solid traction of the Ready-to-Wear and continuous enrichment of Leather Goods, both in terms of newness and icons. The FW25 Men’s and Women’s shows showcased the brand’s creative codes and were well received by the audience. The client experience was further elevated through immersive hospitality projects including the debut of Mi Shang Prada Rhong Zhai in Shanghai, conceived by renowned arthouse director Wong Kar Wai, and the opening of Prada Caffè in Singapore. At the end of the quarter the brand unveiled an exclusive dedicated men’s store on 5th Avenue.

Miu Miu continued to enjoy remarkable momentum built on a free and unconventional aesthetic. Leather Goods remained the fastest-growing category, supported by impactful initiatives like the SS25 Leathergoods campaign, celebrating the iconic Matelassé. Dynamic creativity fueled the success of Ready-to-Wear and Footwear, shaping a well-diversified product offering. The acclaimed FW25 fashion show, the launch of Miu Miu Gymnasium sport-inspired pop-ups and the unveil of Miu Miu Custom Studio project continued to sharpen the brand’s identity and empower its voice in the cultural debate.

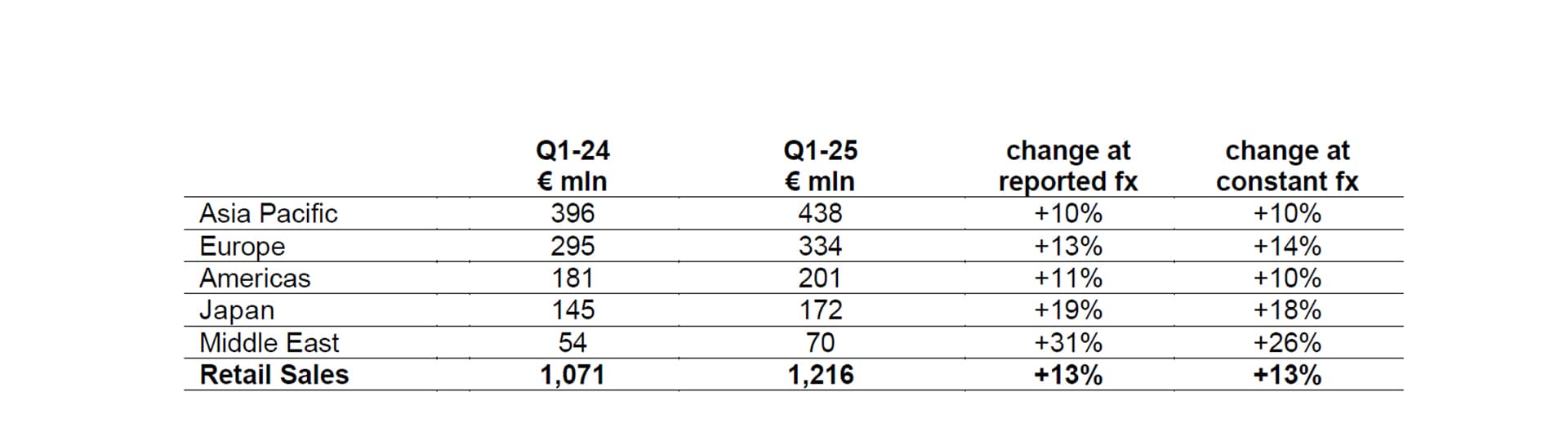

Retail Sales (growth percentage at constant currency)

The Retail channel delivered +13% yoy, driven by like-for-like, full price sales.

Prada Retail Sales remained stable yoy, a resilient performance against the highest quarterly comps of 2024; Miu Miu confirmed an excellent growth trajectory, +60% yoy, showing continued strength across categories and regions.

Asia Pacific registered solid growth of +10% yoy, notwithstanding the challenging comparison base and broadly unchanged market conditions in the region.

Europe +14% yoy, supported by both domestic and tourist spending.

Americas +10% yoy, despite increased volatility during the period, supported by local demand.

Japan continued to perform very positively, up +18% yoy, albeit in progressive moderation which is expected to continue.

Middle East ended the quarter as best performing region, with Retail Sales up 26% yoy.

*Unaudited figures