HIGHLIGHTS

Purpose and Values

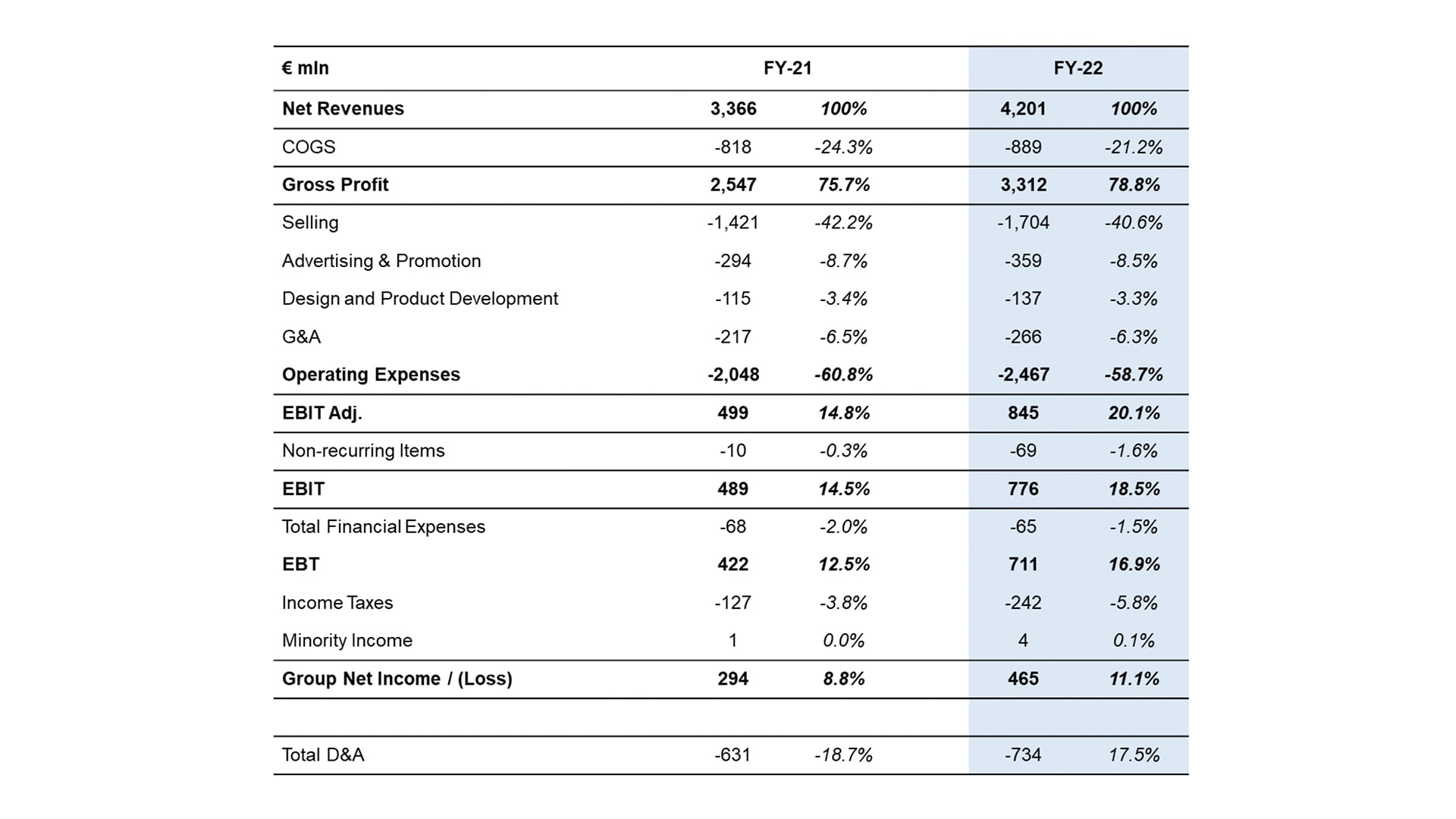

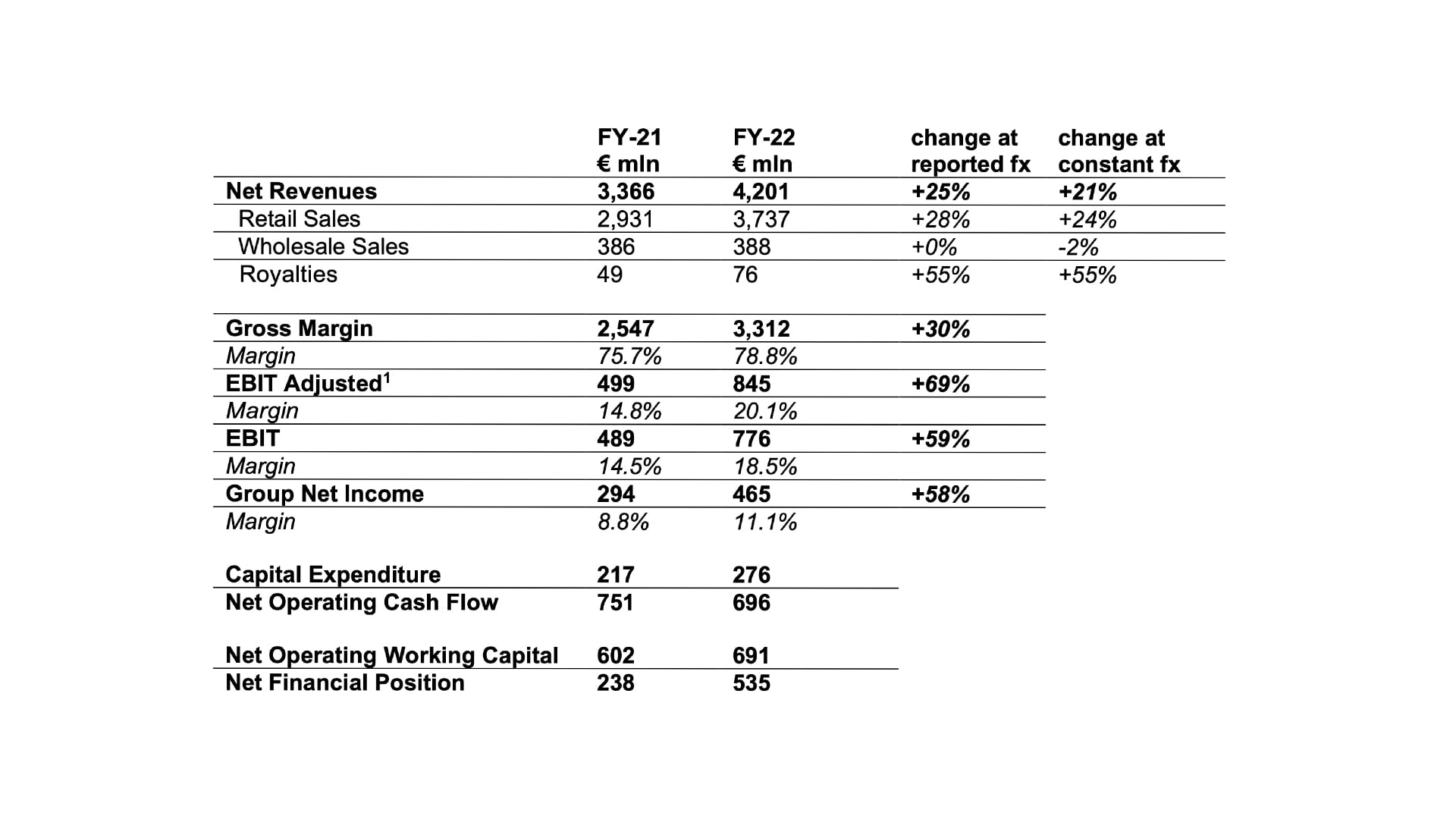

Margin targets achieved; accelerated trajectory for remaining mid-term targets due to

disciplined execution of the Group strategy

Milan, 9 March 2023 - The Prada S.p.A. Board of Directors today reviewed and approved the Consolidated Financial Results for the Full Year ended 31 December 2022.

Key highlights (growth percentage at constant currency)

Patrizio Bertelli, Executive Director, commented:

“Prada Group delivered excellent results in 2022, underpinned by brand momentum, greater client engagement and rigorous strategy execution. The Retail channel drove our performance, achieving strong and broad-based organic growth at both Prada and Miu Miu. We performed well across all product categories and geographies, more than offsetting weakness in China due to Covid-19. We continued to develop our sustainability capabilities and activities, ensuring they remained linked to the identities of our brands and relevant to our clients. The recent changes to our governance structure mark a fundamental evolution for the Group. In 2022, we further strengthened our positioning and our organisation, and in the current year we will accelerate the execution of our strategy. We intend to stay on a path of steady and sustainable growth as we work towards the full potential of our brands.”

Andrea Guerra, Group Chief Executive Officer, added:

“I have joined the Prada Group at an exciting time of evolution, and I have found great energy. The Group’s growth potential is large, thanks to its extraordinary creative vision and industrial strength. We will further invest in the desirability of our brands, in the renovation of our retail network and in manufacturing capabilities. Execution will remain critical in the coming years, and we shall continue to build retail excellence, developing more frequent and stronger connections with our clients. In 2023, we expect revenue growth to remain solid and above market average. China has restarted to be an engine of growth; however, in this ever-changing scenario, we will remain vigilant and maintain a disciplined approach to costs and capital allocation.”

Prada and Miu Miu: bold brand heat

In Q4 2022, the Prada Group was the only luxury company to feature its two main brands within the top five of the Lyst Index: Prada ranked first, and Miu Miu fourth.

Lyst also nominated Miu Miu “Brand of the Year”.

Over the year, successful product launches for both brands, effective talent strategy and lively event formats, contributed to the dialogue with growing audiences and strengthened brand awareness.

Retail Sales: remarkable performance drives growth at both Prada and Miu Miu

(growth percentage at constant currency)

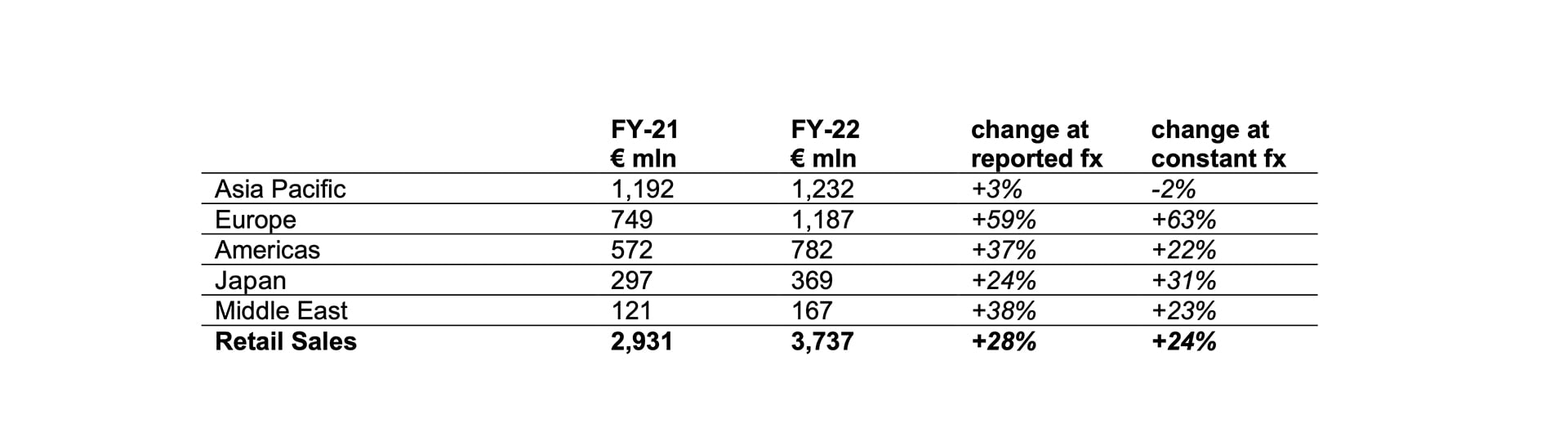

The Retail channel saw sustained growth throughout the year, with sales up 24% yoy driven by like-for-like, full price sales.

Growth was balanced across Leather Goods (+18%), Ready To Wear (+27%) and Footwear (+29%) categories.

Online Sales saw double-digit growth, following investments in the channel, including to improve the omni-channel experience. Penetration remains stable at 7% of Retail Sales.

Both Prada and Miu Miu grew strongly, with positive contribution from both average price and full price volumes.

In particular, Prada revenues grew by 25% yoy showing sustained brand momentum. Miu Miu revenues were up 20% yoy with a sharp acceleration in H2, driven by highly successful products, fashion shows and events.

Asia Pacific declined by 2% yoy to €1,232 mln impacted by multiple lockdowns in China. This was offset by the strong performance in Korea and South-East Asia. The region returned to moderate growth in H2, with sales up 3%.

A strong performance in Europe saw broad-based, sharp growth of 63%, sustained by domestic sales and an uptick in tourism throughout the year.

The Americas generated growth of 22% over the year with a normalisation in H2 due to the increasingly strong comparatives and outbound tourist flows.

Japan grew 31%, with an acceleration in H2, and Middle East also saw solid growth throughout the year, up 23% in total.

ESG: continued progress against strategy

The Group further strengthened ESG governance to accelerate progress against its strategy.

In 2022 the Group focused on reducing Scope 1 & 2 emissions, with investments in renewable energy, electrification of industrial sites’ heating systems, green company car fleet and self-produced energy from owned photovoltaic systems.

In August, the Group also joined the Re.Crea Consortium, founded with other prominent Italian luxury brands, to manage product end-of-life and promote circularity.

The Group has also defined a Diversity, Equity and Inclusion (DE&I) roadmap whose implementation will start over the course of this year.

Finally, the Sea Beyond educational programme in partnership with UNESCO-IOC continued, with even greater ambitions for 2023.

2022 dividend

The Board of Directors propose to the Shareholders’ General Meeting, convened for April 27th, a dividend distribution of € 0.11 per share.

1 L’EBIT Adjusted excludes other non-recurring income and expenses that, for the twelve months ended December 31, 2022, consisted of € 42 mln writedown of non-current assets in Russia, € 19 mln writedown of the Church’s brand, and € 8 mln for settlement of a litigation.

APPENDIX