HIGHLIGHTS

使命与价值观

Milan, 30 July 2025 – The Prada S.p.A. Board of Directors reviewed and approved today the consolidated financial results for the first half ended 30 June 2025.

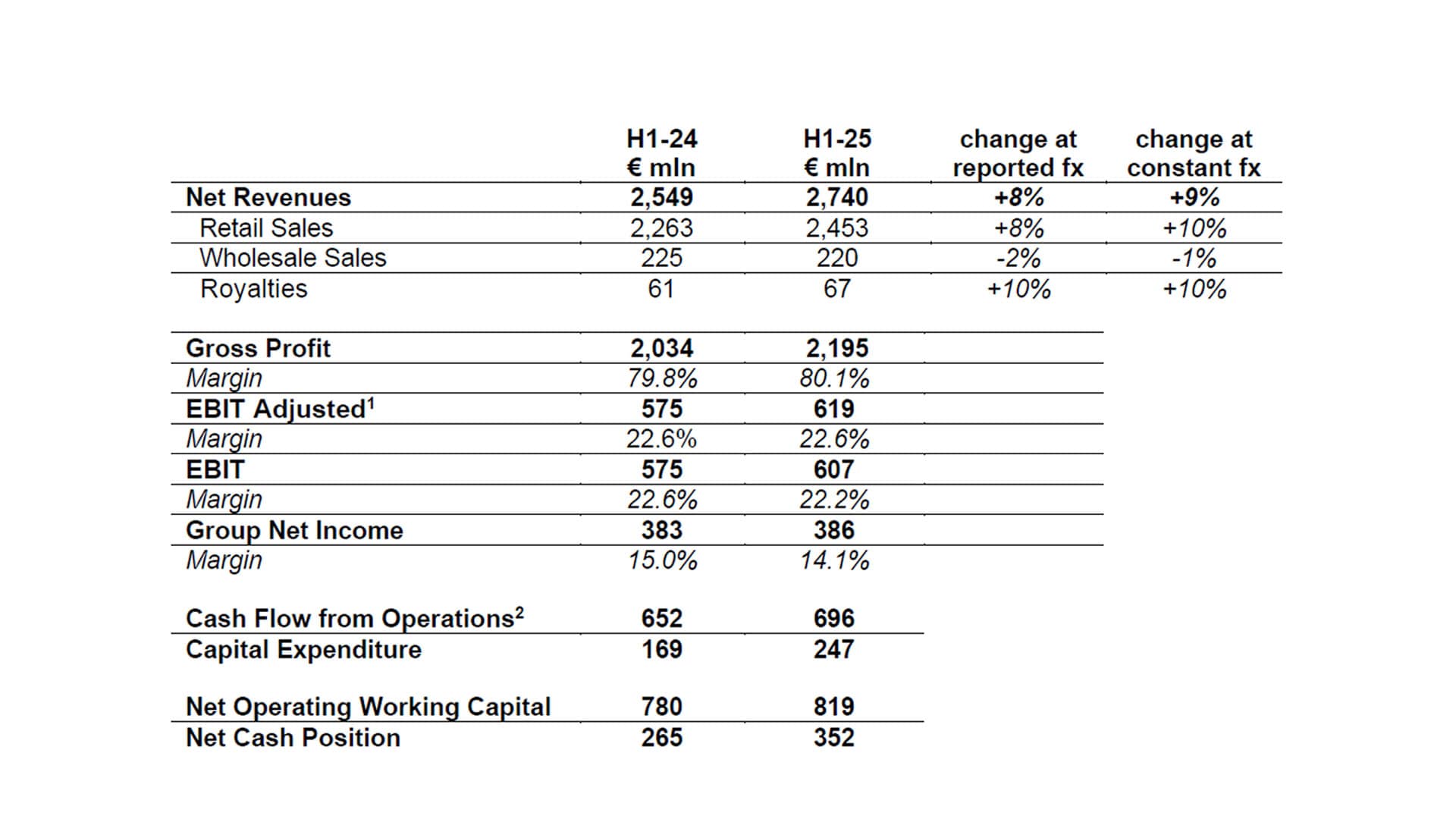

Key highlights (growth percentage at constant currency)

Patrizio Bertelli, Prada Group Chairman and Executive Director, commented:

"In the first half of the year we delivered a sound set of results, testament to the strength of our brands and disciplined execution. This healthy performance was achieved against a challenging backdrop, somewhat unprecedented in our industry. We believe the structural growth opportunities remain unchanged, but we are conscious that in the short term we may continue to face a turbulent economic environment. We remain focused on the long-term with an approach that is mindful of the context. As always, our efforts are centred on the product and the client experience, whilst we continue to strengthen our industrial capabilities and our organisation.”

Andrea Guerra, Amministratore Delegato del Gruppo, added:

“We close these first six months with a solid Q2 building on a good start to the year. We owe this performance to the cultural relevance of our brands, their creativity and ability to anticipate and interpret contemporaneity. Over the period, Prada showed resilience against increasingly subdued demand dynamics and high comps; Miu Miu continued on a healthy path of sustainable growth. Certain headwinds are likely to be more cyclical than structural, but it is essential to execute with focus. Looking ahead, while being vigilant and nimble, we remain committed to our strategy and to our ambition to deliver solid, sustainable and above-market growth.”

Retail Sales by brand (growth percentage at constant currency)

The Retail channel recorded growth of +10.1% yoy, with solid Q2 at +7.6%.

Prada delivered a resilient performance against high comps, with Retail Sales at -1.9% yoy in H1, and Q2 at -3.6% yoy. The brand continued to captivate with its polyhedric and multifaceted take on contemporary society. Creative dynamism translated into a continuous enhancement of icons, with signature Re-Nylon reinforcing the brand’s distinctive aesthetic codes through new and enriched combinations of shapes and colours. Impactful campaigns like Days of Summer and SS25 amplified the introduction of newness. With the unveil of one-of-a-kind hospitality venues, such as Mi Shang Prada Rong Zhai, and the opening of exclusive stores, notably the Prada Men on 5th Avenue, the brand added powerful dimensions of engagement with its clients and a wider breadth of high-end services. Iconic events like Prada Mode and Prada Frame, alongside exhibitions presented in the Epicenters, kept fostering the brand’s deep link with culture.

Miu Miu continued on a healthy path of sustainable growth, with robust performance of +49% yoy in H1 and +40% in Q2. The brand kept exploring femininity in all its forms playing with irreverent, free-spirited aesthetics. Appreciation remained high across all categories and geographies. Special projects like Miu Miu Upcycled, Miu Miu Custom Studio and Miu Miu Gymnasium kept the brand in the spotlight, while events like Miu Miu Summer Reads, Literary Club and Tales & Tellers fostered a constant, multidisciplinary dialogue with the brand’s community. Finally, over the period, the brand started to ease space constraint with new landmark venues, including a three-storey boutique at SKP Wuhan, showcasing an intimate “home” store concept, and a renovated flagship on New Bond Street, where the original mix of styles is an homage to the brand’s unconventional aesthetics.

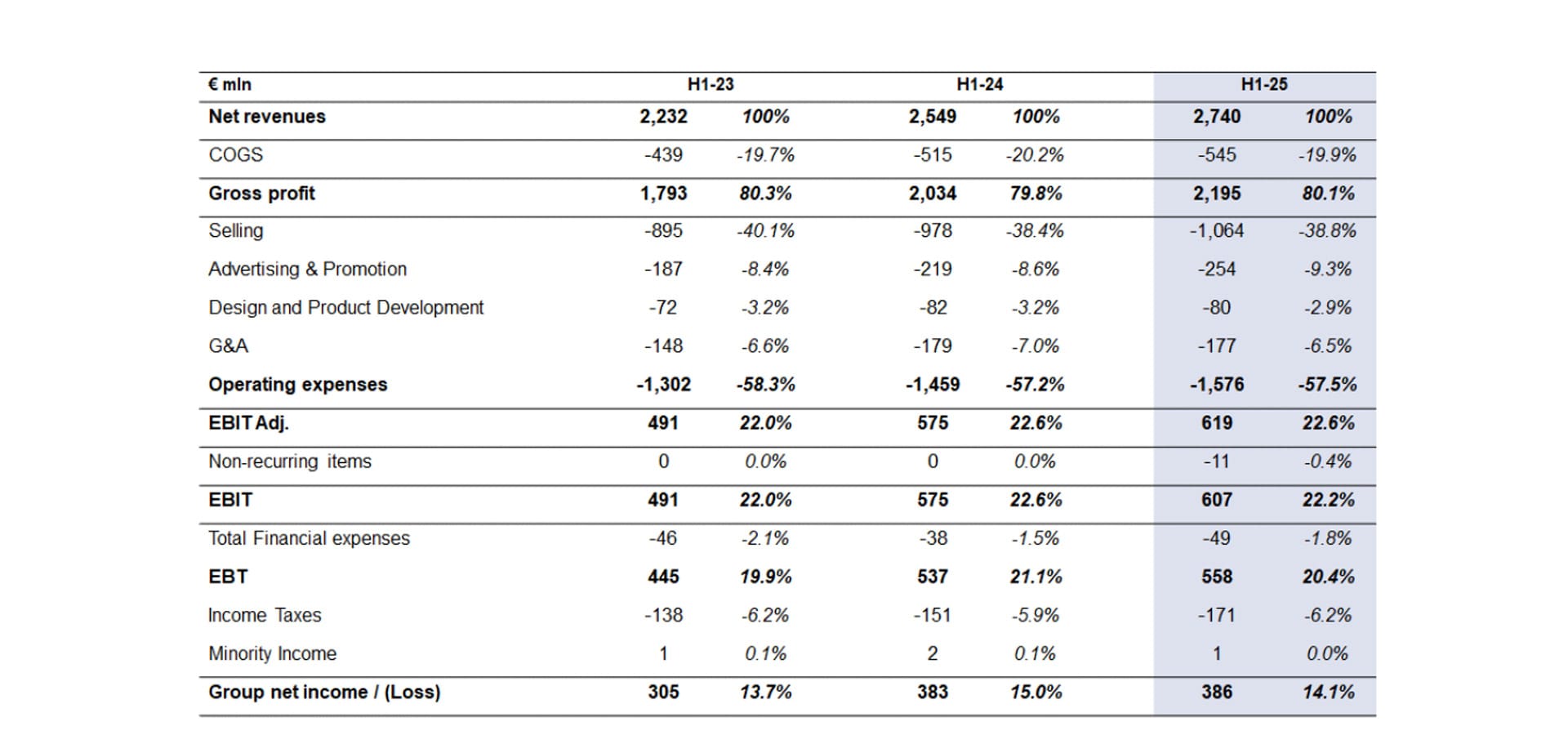

1 EBIT Adjusted excludes other non-recurring income and expenses in H1-25

2 Cash flow from operating activities, less repayment of lease liabilities

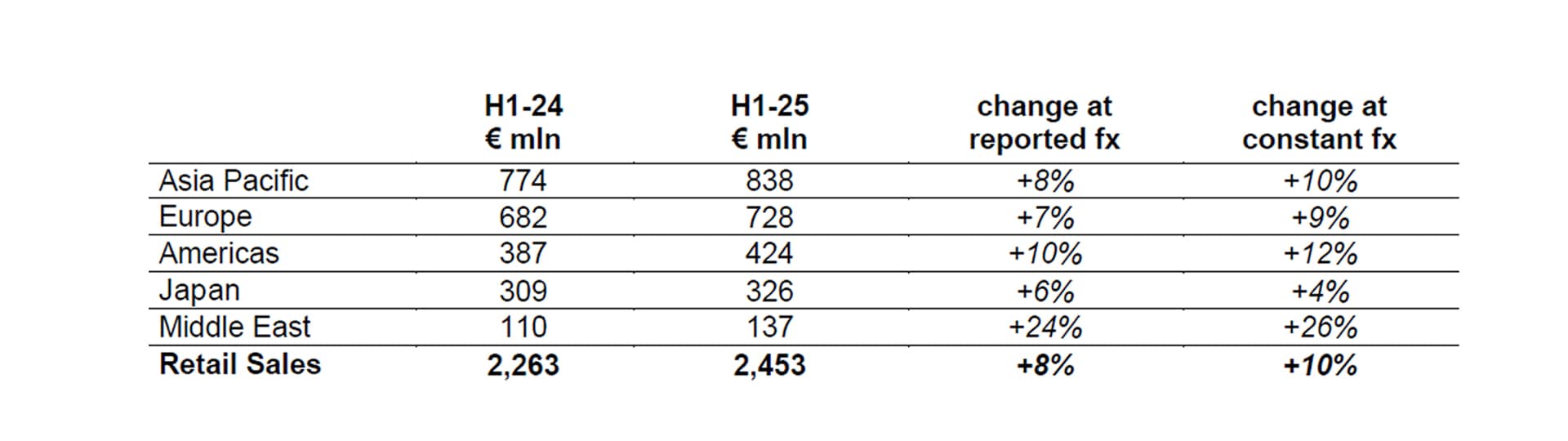

Retail Sales by geography (growth percentage at constant currency)

Asia Pacific exhibited solid growth over the period, at +10%, with similar trends in Q1 and Q2 amid broadly unchanged conditions in the region.

Positive performance in Europe, at +9%; Q2 impacted by lower touristic spending on tough comps on a multi-year basis; local demand remained broadly stable in the second quarter.

The Americas progressed well at +12% in H1, with Q2 improving supported by both local and traveller demand.

Japan registered the most significant deceleration over the semester, at +4%, against exceptionally high tourism in 2024 and in Q2 in particular; as it was the case in Europe, local demand proved more resilient.

Middle East continued to exhibit good growth, at +26% yoy, with similar and stable trends in the quarters.

Other highlights

In H1-25 the Group generated EBIT Adjusted of €619 mln, up 8% vs. H1-24, corresponding to a margin of 22.6%, in line with the previous year notwithstanding higher investments behind the brands. The net income for the semester amounted to €386 mln.

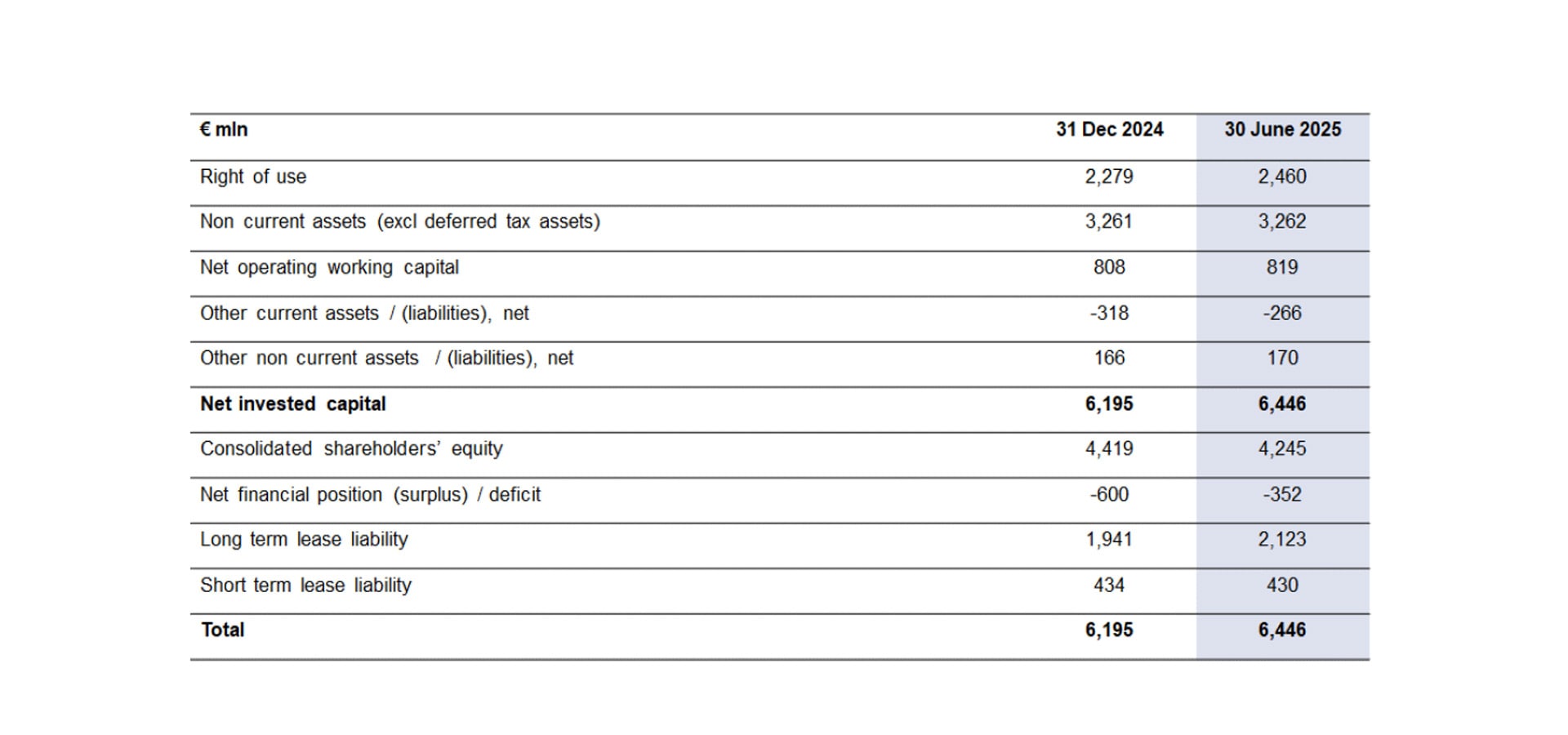

Thanks to healthy cash flow generation, the Group closed the period with a solid Net Cash Position of €352 mln, after dividend payment of €398 mln and Capital Expenditure of €294 mln.

In April 2025 the Group announced the acquisition of Versace from Capri Holdings for an Enterprise Value corresponding to €1.25bn. The transaction is expected to close over the course of H2-25 and is subject to customary closing conditions and regulatory approvals.

In June 2025 the Group also completed a 10% equity investment in Rino Mastrotto Group, a global provider of leather, textile and bespoke services for the luxury industry.

Finally, the Group continued to exert strategic efforts encompassing all key areas of its sustainability agenda. Progress was made in the transition plan towards lower-impact raw materials, on responsible chemical management, as well as towards overcoming traceability challenges. As for the People pillar, DE&I and gender equity were the key focus, with initiatives including global people culture forums to drive regional activities, training, awareness programmes and salary review processes with specific targets relating to gender pay-gap.

Finally, the Group confirmed its commitment to culture with the launch of the 'SEA BEYOND – Multi-Partner Trust Fund for Connecting People and Ocean', aimed at implementing new projects on ocean education and conservation alongside UNESCO-IOC.

APPENDIX