HIGHLIGHTS

使命与价值观

Milan, 7 March 2024 – The Prada S.p.A. Board of Directors reviewed and approved today the consolidated financial results for the full year ended 31 December 2023.

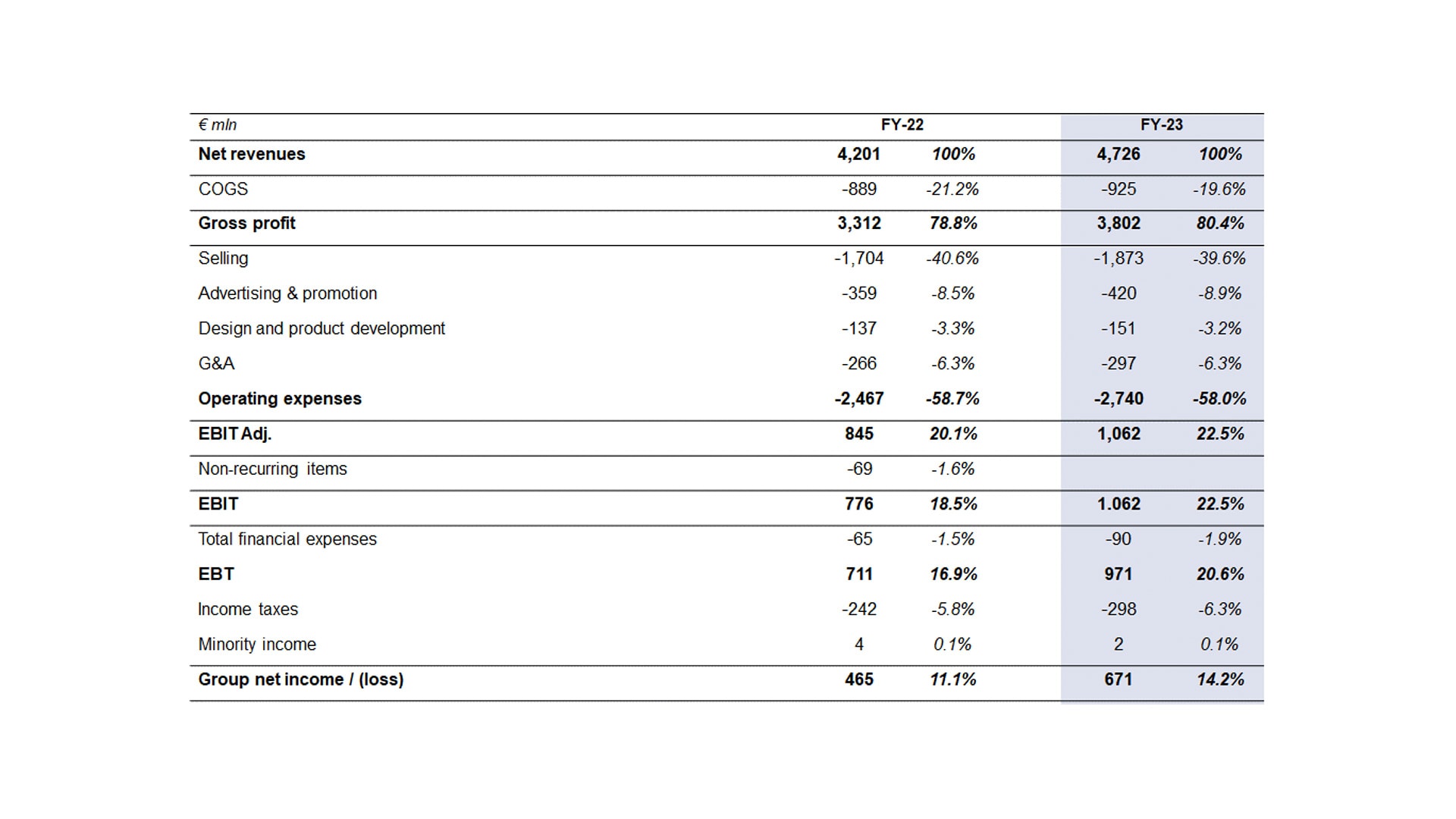

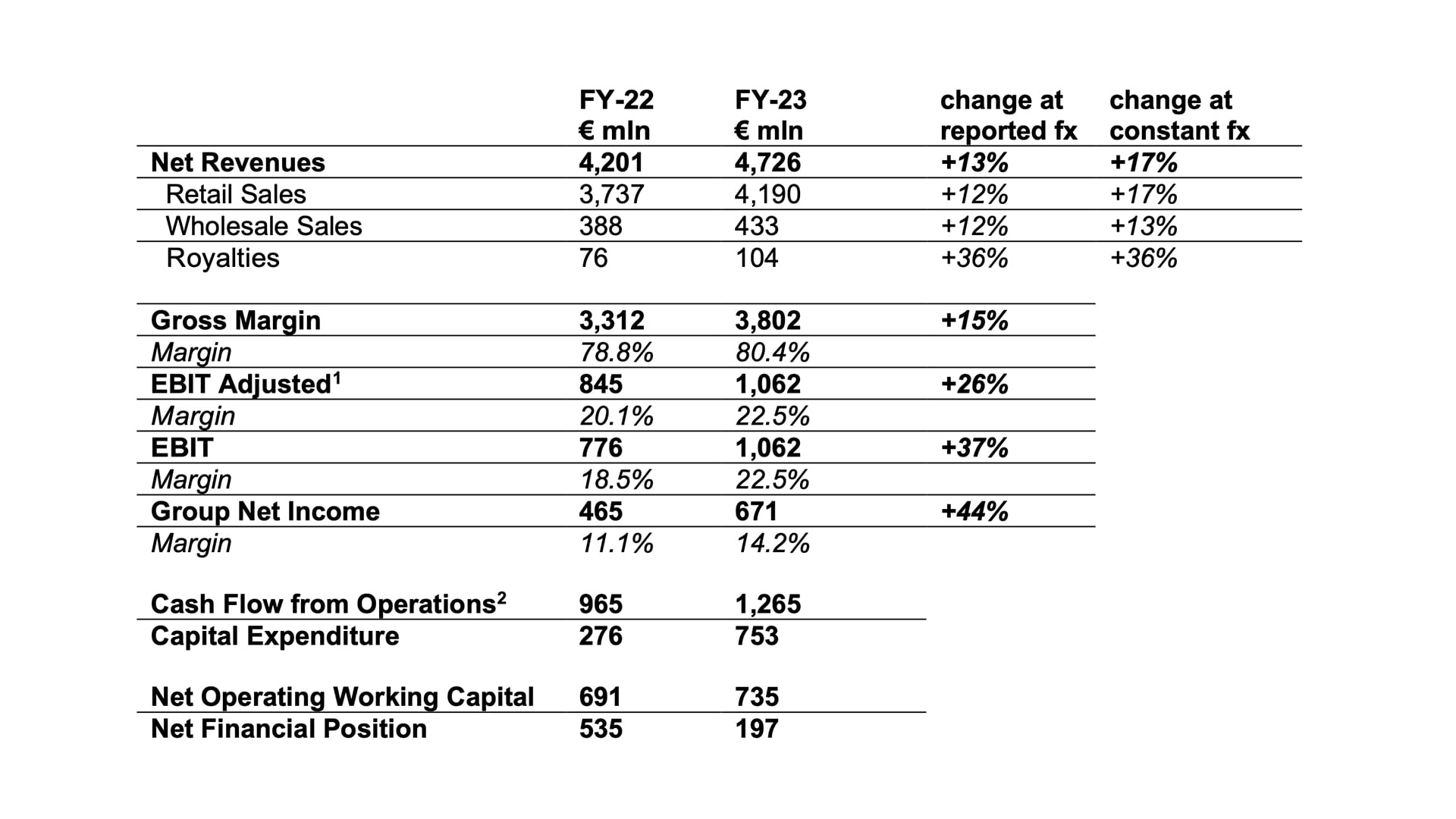

Key highlights (growth percentage at constant currency)

Patrizio Bertelli, Prada Group Chairman and Executive Director, commented: “We are pleased with the strong results achieved in 2023, underpinned by our brands’ desirability. The Group delivered high-quality growth in revenue and profits, building on outstanding creative momentum, further improving its profitability, and stepping up investments to support the growth of tomorrow.”

“Innovation, dynamism, and flexibility will be even more key to our success in 2024, and I am confident that our reinforced organisation will be able to further evolve the Group.”

Andrea Guerra, Group Chief Executive Officer, added: “We have successfully delivered on our ambitions in 2023, with excellent performance achieved consistently through the year, as brand desirability grows stronger fuelled by a combination of product, communication, and retail initiatives. Retail productivity and profitability improved for the third consecutive year, thanks to once again strong doubledigit, like-for-like growth.”

“Looking ahead, we are mindful of this high comparison base as well as persisting macro and geopolitical uncertainties. Against this backdrop, our priority for 2024 remains to drive brand desirability and retail excellence further. As with 2023, while quarterly growth trajectory may not be linear through the year, we retain our firm ambition of delivering solid, sustainable, above-market growth.”

Continued positive momentum for Prada and Miu Miu

Prada had a successful year characterised by sustained desirability, a significant evolution of the organisation, and rigorous execution. Both Menswear and Womenswear fashion shows were highly acclaimed, confirming the enduring success of the brand’s creative codes and its cultural relevance in the industry. Impactful communication and a strong talent strategy boosted visibility and interest globally. A well-balanced product category mix drove growth and resilience, thanks to the ability to continuously innovate and to successfully interpret contemporaneity. The unveiling of several activations, including the spectacular Pradasphere II exhibition in Shanghai, contributed to deliver a distinctive brand experience worldwide, while exclusive collaborations such as the partnership with Axiom Space on NASA’s lunar spacesuits continued to surprise and delight audiences.

Miu Miu confirmed its outstanding performance, supported by the strong foundations laid in recent years across brand, product, distribution, and talent. Strong brand momentum enabled growing awareness and desirability for the brand, resulting in a remarkable commercial response across all categories. 2023 saw multiple successful launches across Leather Goods and Footwear, as well as a strong performance in Ready-To-Wear, cementing the brand positioning as trend-setter. Brand heat was also supported by powerful campaigns and several talent activations, while successful event formats and special projects continued to foster the Miu Miu global community.

1 EBIT Adjusted excludes other non-recurring income and expenses for FY-22

2 Cash flows from operating activities less repayment of lease liability.

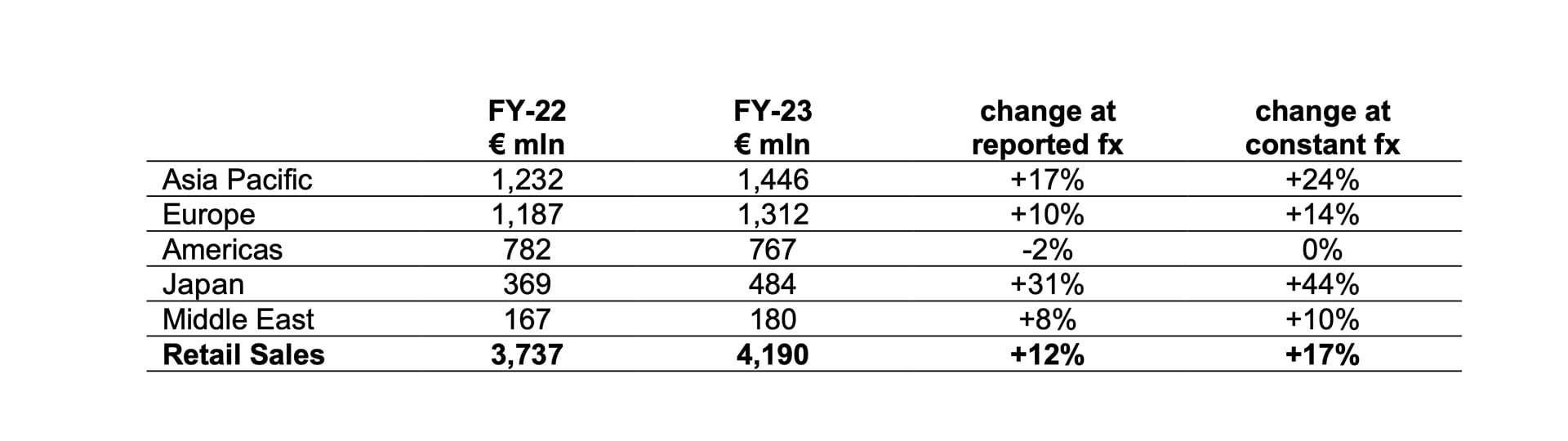

High quality Retail Sales growth throughout the period (growth percentage at constant currency)

The Retail channel delivered +17% yoy growth, with a strong Q4 performance of +17% yoy, accelerating vs. Q3 (+10%), reflecting solid underlying growth and also an easier basis of comparison in China.

Including Q4, the Group has reported 12 consecutive quarters of Retail growth, driven by full price like-for-like sales, with positive contributions from both volumes and average price. This growth has resulted in solid improvements in productivity, which remains a key priority for the future.

Retail Sales of the Prada brand increased by +12% yoy in the period, including solid growth in Q4 (+10% yoy), accelerating vs. Q3 across all categories.

Miu Miu’s excellent full-year organic growth, +58% yoy, was supported by all categories and regions, ending the year with a remarkable Q4 at +82% yoy.

Asia Pacific saw strong growth over the year, +24%, also considering the volatile basis of comparison in 2022, impacted by multiple lockdowns in China.

Europe grew +14% over the year, as a result of strong domestic and tourist spending. Growth was significant in H1, and Q1 in particular, with more normalised but solid performance thereafter.

The Americas remained flat over the full year period with a sequential improvement in Q4, supported by some repatriation of spending.

Japan was the best performing region in 2023 with growth of +44%, driven primarily by local clients, and with increasing presence of tourists.

Middle East delivered a solid performance in the year, at +10%, despite the intensified geopolitical headwinds.

ESG

The Group continues to reduce the impact of its operations, in line with its climate strategy. It is making strong progress towards its 2026 Science-Based Targets for Scope 1&2, reducing GHG emissions by 58%, compared to a 2019 baseline.

Work also continues on initiatives to reduce Scope 3 GHG emissions in line with the Group’s 2029 Science-Based Target. Specifically, the Group is focusing upstream on the transition of some key raw materials such as cotton and synthetic fibers to lower impact alternatives, as well as improving efficiencies and measuring the environmental impact of its iconic materials and products through LCA. Most recently, the Group has invested in sustainable aviation fuels (SAF) contributing to the decarbonisation of the aviation industry.

More than 75% of the Group’s leather and textile suppliers are also involved in the ZDHC (Zero Discharge of Hazardous Chemicals) program. This aims to better manage hazardous chemicals in manufacturing processes and therefore reduce the impact on the ecosystem. As part of this, the Group has set new certification targets for leather and viscose.

On the People part of our ESG strategy, the Group is particularly proud of its initiatives centered on gender equality and the achievement of 44% women in its leadership team. Of note, a new Chief People Officer was appointed in September 2023.

The Group’s commitment to culture and water conservation continues, with increased funding to support the SEA BEYOND education program, which has been expanded to include scientific research and humanitarian projects, with a focus on increasing ocean awareness.

2023 dividend

The Board of Directors will propose to the Shareholders’ General Meeting, convened for April 24th, 2024, a dividend distribution of €0.137 per share.

APPENDIX